Navigating Healthcare's New Era: How In Touch Billing Prepares You for Policy Changes Ahead

President Trump's second term is ushering in significant healthcare policy transformations, building on initiatives from his first administration while introducing fresh priorities that are reshaping the entire industry landscape. These sweeping changes are creating both challenges and opportunities that demand immediate attention from all healthcare organizations.

As regulatory frameworks shift and new compliance requirements emerge, healthcare organizations face mounting pressure to adapt quickly while maintaining operational efficiency. The complexity of these policy changes can overwhelm even the most experienced billers, disrupting revenue cycles and creating costly compliance gaps. This is where In Touch Billing becomes your strategic advantage.

Our comprehensive billing services are specifically designed to help your practice navigate policy transitions seamlessly.

With our deep understanding of regulatory changes and proven track record of adapting to healthcare reforms, In Touch Billing ensures your organization stays ahead of compliance requirements while optimizing revenue performance. Don't let policy uncertainty disrupt your practice's success. Partner with In Touch Billing and transform these healthcare shifts from challenges into competitive advantages for your organization.

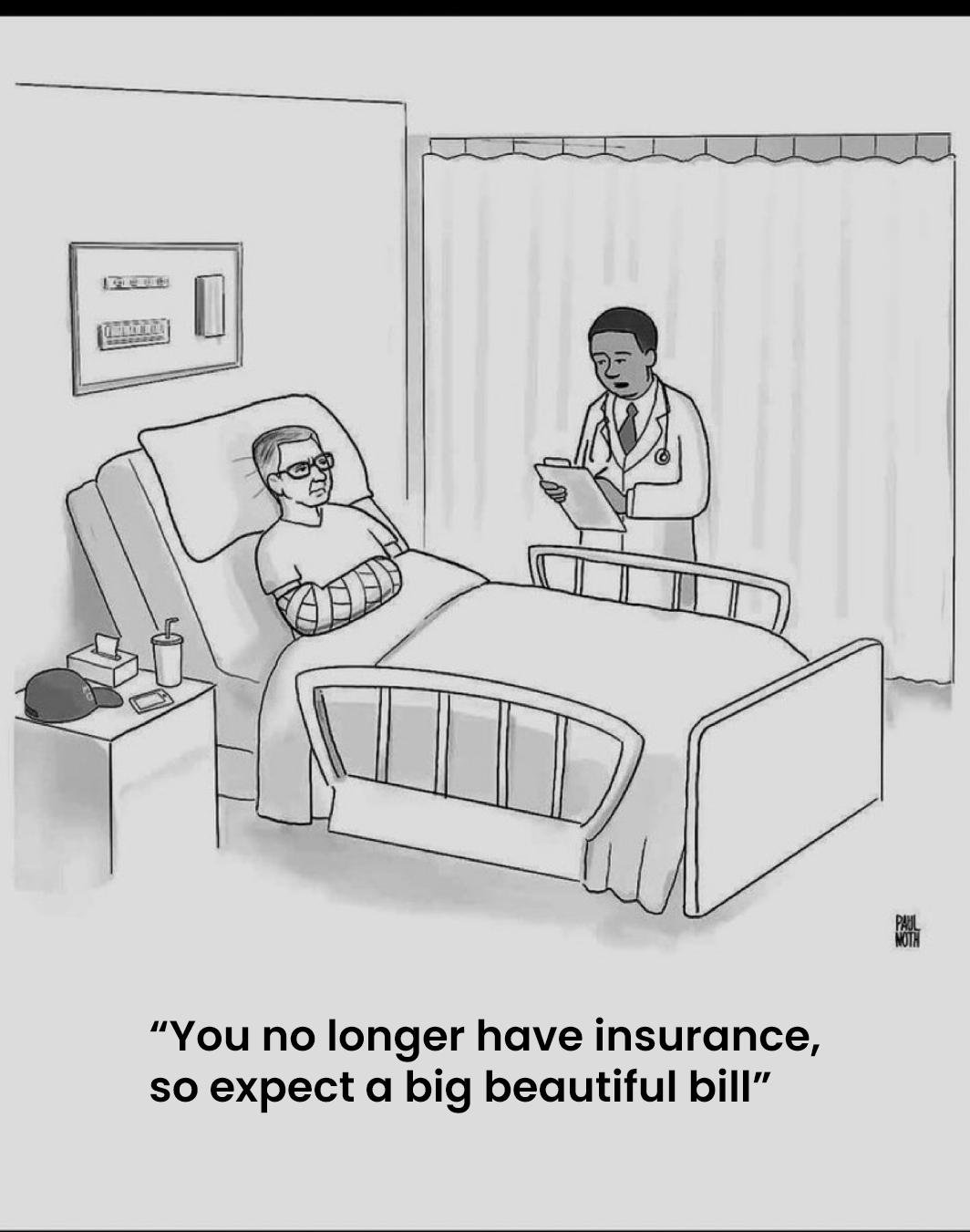

The Big Beautiful Bill (BBB) is now law - the most comprehensive healthcare legislation in decades, this sweeping reform is fundamentally reshaping federal healthcare financing, ACA Marketplace operations, and healthcare delivery nationwide. While these changes create unprecedented challenges for healthcare organizations, In Touch Billing has already developed the solutions you need to thrive in this new landscape.

The Payer Reimbursement Game Just Changed Forever

Here Are the 4 Seismic Shifts That Will Make or Break Your Practice

1. Funding Cuts Demand Smarter Revenue Management

With federal spending projected to drop by $1 trillion over the next decade through block grants, per-capita caps, and service restrictions, healthcare providers face dramatic reimbursement changes and enrollment decreases. In Touch Billing's advanced revenue cycle management ensures you capture every dollar available while adapting seamlessly to new reimbursement structures.

2. Complex Eligibility Changes Require Expert Navigation

Frequent eligibility reverifications are creating administrative nightmares and coverage disruptions. Our specialized billing expertise helps you navigate these complex eligibility changes, minimize claim denials, and maintain cash flow despite increased administrative burdens.

3. ACA Marketplace Restrictions Need a Strategic Response

Eliminated automatic re-enrollment, reduced premium tax credit eligibility, shortened enrollment windows (10 weeks to 6), and stricter payment grace periods (90 days to 30) are complicating patient coverage. In Touch Billing's comprehensive insurance verification and patient communication systems ensure you're prepared for coverage gaps and payment challenges before they impact your bottom line.

4. New Opportunities Require Expert Implementation

The $50 billion Rural Health Transformation Fund and expanded consumer-directed health options (permanent pre-deductible telehealth, higher HSA limits, expanded eligible expenses) create new revenue streams—but only for organizations positioned to capitalize on them. Our forward-thinking billing solutions help you identify and maximize these emerging opportunities.

Don't Navigate These Changes Alone

The BBB Act's complexity demands a billing partner who understands both the challenges and opportunities ahead. In Touch Billing combines deep regulatory expertise with cutting-edge technology to ensure your organization not only survives these historic changes but emerges stronger than ever. Schedule a call with In Touch Billing today. We have a clear protocol to:

- Follow up aggressively on every claim

- Push back against payers including third party companies

- Optimize your billing by identifying which CPT codes and payers pay the most (analytics and intelligent insight to help you with decision making)

Only billers who collect payments religiously, commit to a sound approach, stop looking for short cuts, and take personal responsibility for every dollar can help you fight back against payers.

At In Touch Billing, we have over 200 staff members, and separate ‘silos’, where individual teams are responsible for

- Documentation review to ensure compliance for all clients

- Coding claims, including payer specific guidelines and modifiers

- Submitting claims and following up until payment is received

- Posting payments, but only after reviewing EOBs to make sure the payer paid CORRECTLY

- Appealing / resubmitting the claim until payment is received

In Touch Billing has a separate department for each of these tasks, and every single client of ours (big or small) gets the same quality of service. That’s why our clients call us the #1 biller in America.

Your in house biller cannot do all this, because they are outmatched by insurance companies, who deny, deflect and confuse.

Get In Touch Billing to do your billing, benefit verification and credentialing and win the never ending battle against payers. You get everything done for you. All you have to do right now is schedule a call to learn more. No contracts, no setup fees, no cancellation fees. Pay as you go and make us an extension of your clinic. You have nothing to lose, and everything to gain by working with In Touch Billing.

There’s a reason why we’ve been called the county’s #1 billing service for healthcare organizations. We know exactly how to beat the payers at their own game, and maximize your revenue.

In Touch Billing: Your Revenue Recovery Warriors

At In Touch Billing, we don't just process claims, we wage war on denied payments and fight relentlessly for every dollar you've earned. Our battle-tested army of over 200 AAPC certified billers and coders stands ready to combat insurance companies, challenge unfair denials, and pursue every cent owed to your practice.

We refuse to accept the typical "vendor" relationship. Instead, we serve as your dedicated revenue warriors, armed with expertise, determination, and an unwavering commitment to your financial success. When insurance companies try to shortchange you, when claims get buried in bureaucratic red tape, when denials pile up - that's when our team springs into action.

Your fight becomes our fight. Your revenue becomes our mission.

With In Touch Billing in your corner, you're not just getting a billing service - you're gaining fierce advocates who treat your practice's financial health as if it were our own. Because in the battle for healthcare reimbursements, you need warriors, not just workers.

Ready to stop losing money to insurance companies? Let In Touch Billing's revenue warriors fight for what's rightfully yours.

How can you fight and win this battle? With an effective billing company like In Touch Billing.

What You Should Do Next

What You Should Do Next

At In Touch Billing, we evaluate the clinical documentation for our clients, and help clients determine which codes to bill. We are your built-in compliance, ethics and reimbursement team all rolled into one. You can use any EMR / billing software of your choice, or we can make recommendations if you want to switch.

If you have In Touch Billing do your billing, and if we don’t increase your revenue by 15-20%, you don’t pay us for the first month.

How can we make such a bold promise?

We know how to boost your revenue, because we’ve done exactly that for over 1000 private practice owners across the country.

We’ll handle all your billing, benefit verification and credentialing and we’ll deploy our own AI tools for you, against payers.

You get everything done for you. All you have to do right now is schedule a call to learn more. Let’s explore your options.

No contracts, no setup fees, no cancellation fees. Pay as you go and make us an extension of your clinic.

You have nothing to lose, and everything to gain by working with In Touch Billing. There’s a reason why we’ve been called the county’s #1 billing service for private practice owners. We know exactly how to beat the payers at their own game, and maximize your revenue.

In Touch Billing is a doggedly determined company that fights for every single client with an arsenal of over 200 AAPC certified billers and coders, a highly organized and skilled team to help you get paid. We don’t see ourselves as your ‘vendor’ or ‘biller’, we are your warriors who will fight for every dollar, every claim on your behalf.

Here are FOUR things we do for our clients that other billing companies don’t:

- AAPC-certified coders carefully review your documentation and provide feedback to make sure your documentation aligns with each payer’s guidelines.

- We renegotiate contracts and encourage payers to pay you more every year (high success rate).

- We can handle payer credentialing for new and existing providers.

- We can verify benefits and help you with pre-authorizations.

The result - you get paid more, faster.

Click here for FAQs about our service and our transparent pricing model.

Schedule a call with us to learn more. No contracts, no setup fees, no cancellation fees. Pay as you go and make us an extension of your clinic.

Copyright © 2026 In Touch Billing. All rights reserved.